Decentralizing MEV on Rollups With Decentralized Sequencers

In the last blog, we discussed the dark side of MEV extraction and the risk it inflicts on your rollups if it has centralized sequencers. That said, what if we tell you is that a network as strong as Ethereum handling 97% of all its combined transactions on L2s, uses centralized sequencers. Wouldn’t you like to secure your rollups/L2s hosted on top of Ethereum after Linea centralized sequencing exploit, flashbots relay hack, and Ethereum validator exploits by MEV bots. Bet, you would. That being said, as a rollup/ layer2 you know that decentralized sequencers for MEV are your trusted warriors. But what are they and why they are trusted so much to protect the L2/rollups, let’s dig that in this piece where we will discuss about decentralized sequencers for MEV and how they can protect your L2 from MEV exploitations ;

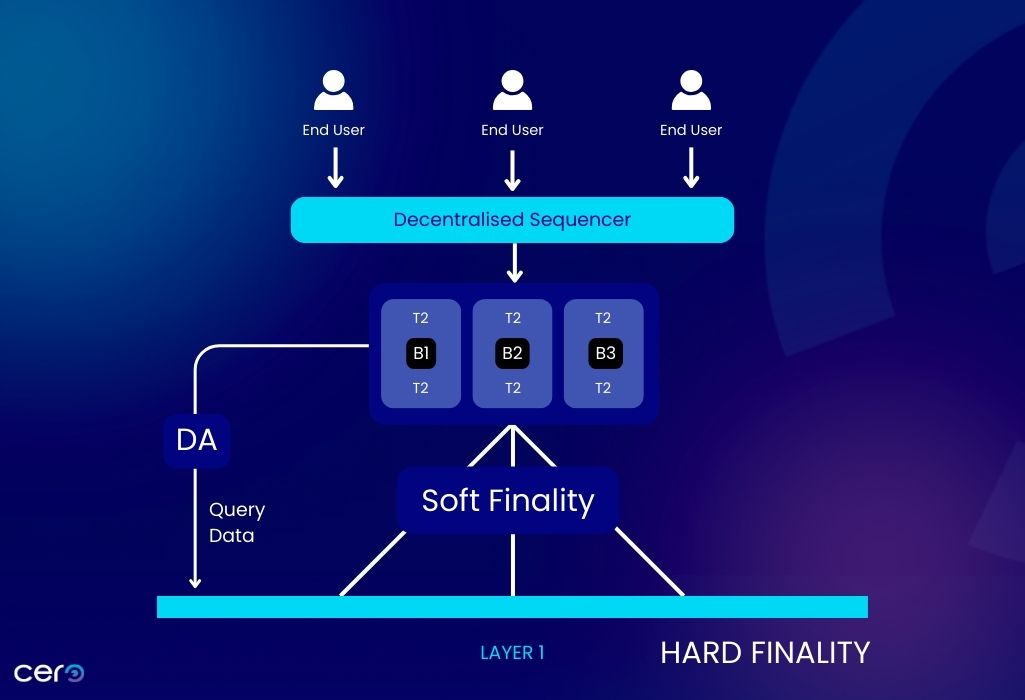

Unlike a centralized sequencer, where there’s a single party aggregating, executing and broadcasting transactions, a decentralized sequencer distributes the task among a large network of nodes. Due to this process, it is possible to achieve decentralization because decentralized sequencers for MEV eliminate the loopholes that centralized sequencers leave. Here’s how they overcome centralized sequencing as mentioned in the image below;

Step 1

Users are submitting the transaction on the rollup RPC nodes. The transactions are then forwarded to the network of sequencers

Step 2

Distributed sequencing begins where instead of a single sequencer determining the order of the transaction, there are multiple nodes involved that would jointly agree to the order as shown in the image above using various consensus mechanisms like PoS, PBFT or others. You can see that there are multiple validators represented as black dots sequencing for the rollup client. They are the decentralized sequencers. What they will do is sequence the transactions and add that to the L1 layer. This is termed as soft commitments/confirmation

Step 3

Once the proof of the soft confirmation reaches the L1 along with the hash of the batch of transaction and data proofs, if these batches are pushed to the DA layer.

Step 4

The L1 will verify all the proofs and provide a hard finality for the transactions and the users can withdraw the funds.

Now the entire process when done through a decentralized sequencer is much more secure and less prone to MEV exploitation because the sequencing has to be approved by all the sequencer nodes participating in sequencing.

But when you have a single sequencer or centralized sequencer, they can easily arrange transcations as per their own will to benefit themselves. Hence, it exposes users to a possible MEV exploitation at the hands of centralized sequencers. And that’s why decentralized sequencers for MEV protection are more trustworthy for a rollups UX. Why so? Let’s find out;

As you already know that liquidity is required to keep the DeFi apps up and running. For that matter, the DeFi applications like Uniswap reward liquidity providers for providing liquidity to the protocol. But a centralized sequencer’s MEV bot can attack and exploit the liquidity providers.

For example, due to the centralization of the sequencers, the MEV bot can identify the pending large swap in the mempool and they can replace the same with their to take the advantage of capitalizing on all the LP fees.

This has already happened on Uniswap, where in the span of the last 20 months, a rogue sequencer was involved in a JIT attack, attacking the liquidity pools 36,671 times to extract 7,498 of ETH in fees. But when you have decentralized sequencing, it becomes hard to include the transaction and simultaneously withdraw the same, draining the ecosystem and bringing the apps hosted on top of L2s to standstill.

As a result, to tackle the JIT attacks, researchers are giving due weightage to decentralized sequencers for MEV and encrypted mem pools for overcoming this innate problem disrupting DEXes like Uniswap and others in 2025.

For any rollups, there’s an alternate route where users can opt for an escape hatch which has been primarily designed to prevent censorship of transactions. But this option can be manipulated in blockchains where there’s a single sequencer, for example, the Base L2 blockchain with Coinbase as the sequencer. How? Sequencers on the Base blockchain cannot completely censor but delay the transaction to increase the gas fees. Now the user has two choices (i) Pay an extra fee on the Escape Hatch to record the transaction (ii) Pay the premium gas at par with the escape hatch.

The user will be forced to choose the centralized sequencer because a centralized sequencer will allow the user to interact with other dapps in the L2 ecosystem. Such an event occurred on the Linea L2 blockchain. The sequencers intentionally paused the block creation for blocks 5081800 and 5081801. This was intentionally done to benefit from sequencing the blocks in the manner that deemed fit for themselves.

But when you have decentralized sequencers for MEV protection, such an incident of MEV will not happen at all. Considering the important role that a decentralized sequencer can play to protect your layer2 rollups, the Linea Blockchain said, “ Linea’s goal is to decentralize our network — including the sequencer. When our network matures to a decentralized, censorship-resistant environment, Linea’s team will no longer have the ability to halt block production and censor addresses – this is a primary goal of our network,”

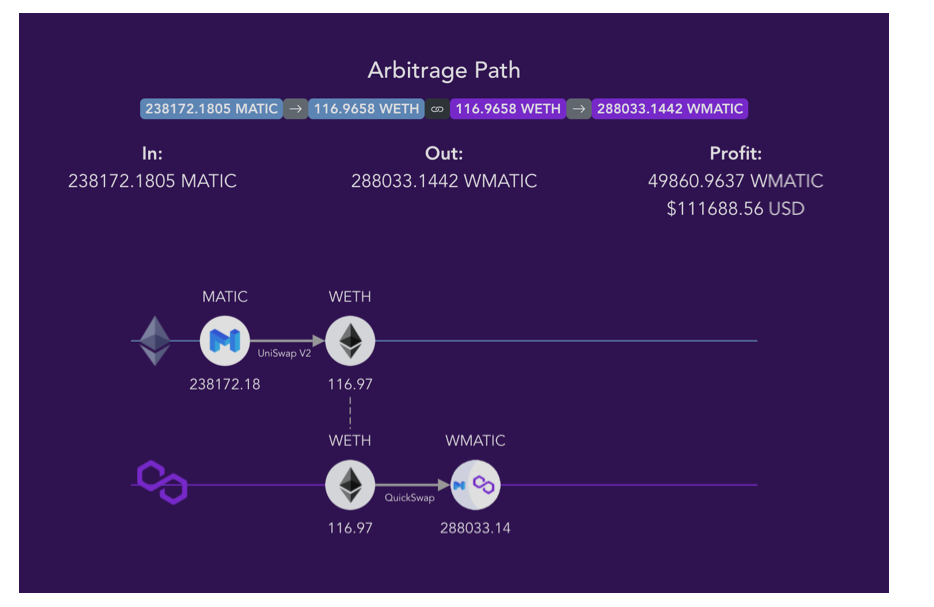

Cross domain MEV is an integral problem of rollups. In a cross domain MEV, there are two domains using the same sequencer. To put that in real terms, at the moment, Optimism is planning to launch a shared sequencer for all the rollups hosted on top of it under its superchain thesis. Such an approach promotes uniformity across a larger rollup ecosystem but with a downside, undoubtedly, i.e., unlimited surveillance. So, imagine having a single rollup sequencer and the sequencer is querying this “ identify the best opportunity available for cross-chain MEV.” The output would come in the following way;

The sequencer was able to do the same because it could see through liquidity pools representing the same asset pairs on each domain, yet with different volume, depth and activity. Now, as a single shared sequencer for all the rollups, the attacker/validator can target those transactions that are benefitting its intentions and subsequently either delay/ input transactions of its own to benefit the sequencer.

But when you are having decentralized sequencers for MEV, there’s a coordinated transaction execution where multiple nodes can join the network and see through a limited number of transactions ending up in the mempool of rollups without compromising scalability, decentralization and security. In this way, it can completely protect the rollup ecosystem from attack vectors as demonstrated above in the form of cross domain MEV attacks.

The problem with traditional sequencers on an L2 is that if you want them to be fast, they can do that but with centralization , whereas, if you want them to be honest, they cannot do that as long as they are centralized. But rollups are looking for a middle-ground: fast & decentralized. Decentralized sequencers are providing that middle ground because the first place you went for a rollup was to speed up the UX. However, if rogue MEV bots are attacking your L2s because you need scalability and high TPS, you need a counter-plan.

Decentralized sequencers for MEV are the counter plan using Byzantine View Synchronicity. Where, a pacemaker is in place that would arrive at a consensus merely by seeing the transactions and including the same in the block through a leader based selection. This happens through a series of updates like VID, random beacons, and DAG Transport Layer would ensure that the block proposing/building remains scalable, decentralized and secure even if N-1 nodes remain honest. Due to this practice, it is also possible to include all the L1 validators for maximum impact on decentralization, trust and security. At this moment, major service providers like Cero are progressing in this regard to help solve the problem of dynamic availability over democratized sequencing to tackle MEV attacks.

Cero, with its numerous goals, wants to integrate ways that can help fight against MEV exploitation by introducing decentralized sequencers for MEV in its future roadmap. From highly configurable sequencing to privacy masking to protecting user’s interest against any type of vulnerability, Cero is committed to provide everything to the rollup ecosystem. Due to this, any blockchain that wishes to completely decentralize their sequencer by abstracting the MEV can do that without spinning up a new chain. They can use an autonomous model for block building and could even introduce a custom execution environment.

In this way, if a sequencer/ proposer is involved in any wrongful activity and detected by the off-chain scripts, which are used as a monitoring tool, the monitoring tool can quickly revoke the admin rights of the sequencers/proposers and introduce new ones to take control of the system.

Since a lot of activity is happening on L2s with more than $45.92B in assets locked and expected to reach $58 B by 2025’s end, we cannot simply assume that every piece of the puzzle will act in the best interest. Rather, we have to build models for the same to protect the ecosystem. With Cero, we can expect that decentralised sequencing will not be too far from integration to secure rollups/L2s from an MEV attack.